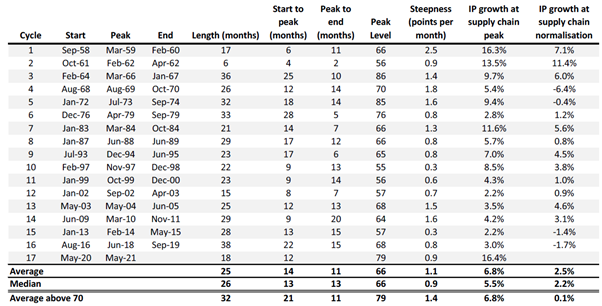

2021 was marked by ongoing supply-chain disruption. But as we enter 2022, are we past the worst? A recent examination of long-term historic ISM (US Institute for Supply Management) survey data from Morgan Stanley looks at periods where lead times in supply chains have remained extended (Figure 1).

Figure 1: Supply chains – how long, how big, how steep … and what happens to IP growth?

Source: Haver Analytics/Morgan Stanley Research, until November 2021

This shows that over the past 60-plus years, the median length of time that supply disruptions last is a whopping 26 months. Up until November 2021 when the table was produced we were only clocking up a mere 18 months. I’m no economist, but this ties in remarkably well with the “bottom-up” conversations we’ve had with companies across a range of industries from automotive, machinery, consumer discretionary and tech hardware and equipment. Purchasing managers at such companies are still using “shrug” emojis in internal emails – there is very little visibility, and few corporates are forecasting a return to normality before the second half of this year with any confidence.

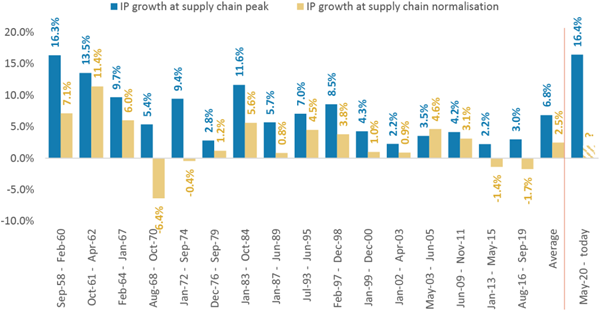

What happens when things get less bad? In a way, they get worse … typically (Figure 2). Morgan Stanley also ran the numbers on what happens to industrial production once supply chains normalise. The answer is that growth falls, and if we look at relatively recent periods of supply tightness beginning early 2013 and early 2016, industrial production actually contracted.

Figure 2: What happens to industrial production growth after supply-chain lead times peak?

Source: Haver Analytics/Morgan Stanley, to November 2021

How do we rationalise this? Orders in backlogs can be less firm than they were initially for many months – call it customer fatigue – and supply tightness can crest the hill into demand erosion from both corporates and consumers. It will be up to stock markets to navigate such concerns over the coming months.

But is it different this time around? These are dangerous words for investors, but may ring true in certain industries and niches. Take heating, ventilation and air conditioning manufacturer Trane Technologies, which recently reported a US orderbook 90% larger than at 2020 year-end . As stimulus cheques are spent, and wealthier US consumers shift spending towards experiences and away from their homes, this could be a headwind. But Trane’s growth will likely be powered more significantly by larger corporate and government clients modernising due to both carrot-and-stick stimulus spending/tightening of emissions regulations – for example, significant spending on aged school buildings. The NextGenerationEU package will provide a similar narrative for Europe’s growth. More broadly, I feel that the theme of the “electrification of everything” – from passenger vehicles through to mining equipment and commercial buildings and factories – will be a stickier one, of higher growth for longer in these areas, even if the broader bounce-back out of Covid-19 slows.