CT (Lux) European Social Bond

This is a marketing communication. Please refer to the prospectus of the UCITS and to the KIID before making any final investment decisions.

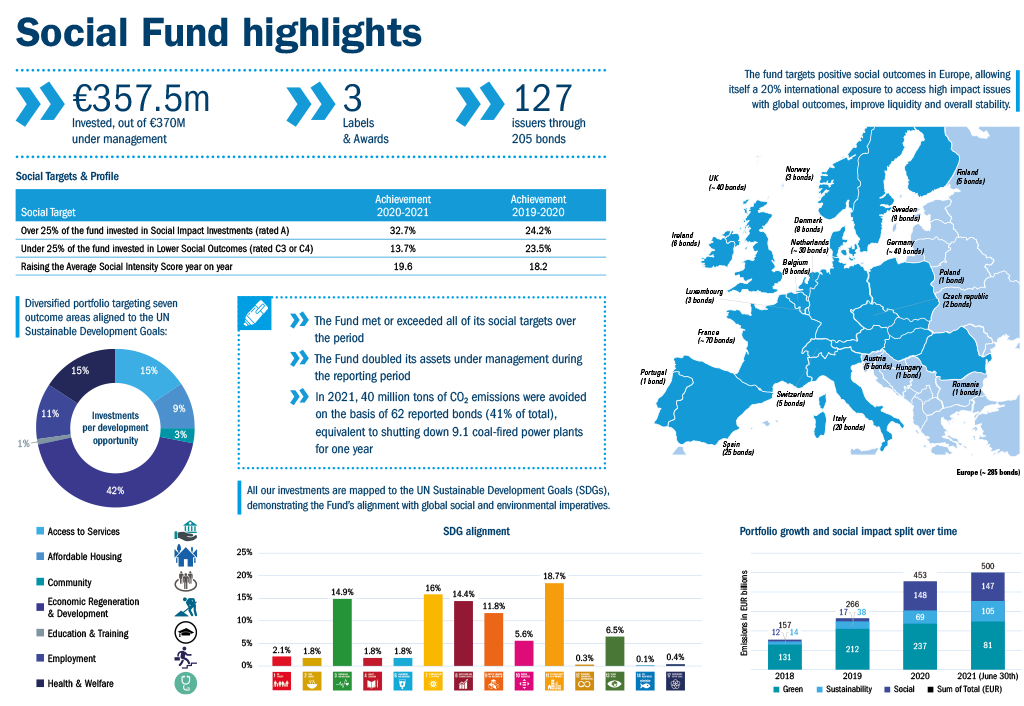

At a glance

Key facts

Article 8*

Fund Inception date:

23 May 2017

Fund Manager

Simon Bond

Benchmarks notes:

Composite index comprising: 50% ICE BofA Euro Non-Sovereign; 50% ICE BofA Euro Corporate Euroland Issuers

Investing in positive social outcomes

We invested in organisations and bonds delivering and enabling tangible impact.

The decision to invest in the promoted fund should also take into account all the characteristics or objectives of the promoted fund as described in its prospectus. The fund’s sustainability related disclosures can be found here.

Annual Social Impact Report

We believe in

Key reasons to invest

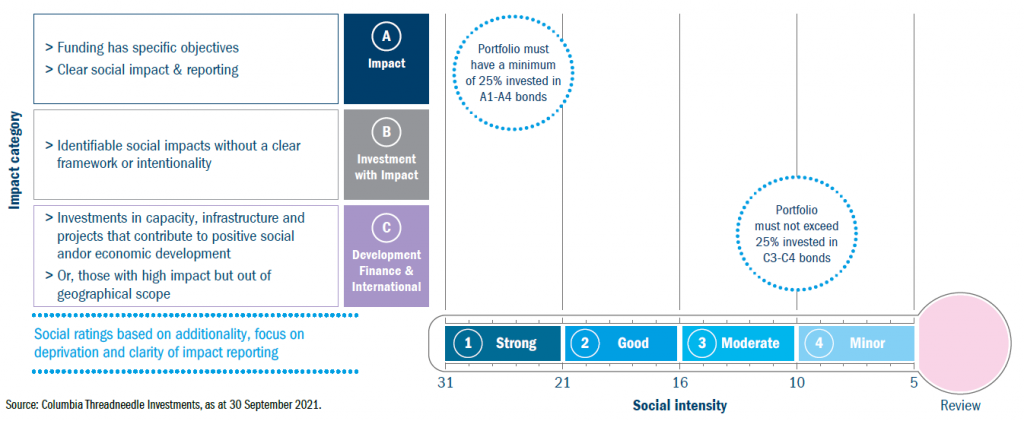

- Innovative approach: Using a dynamic social research methodology to guide investment decisions, the portfolio manager actively sources bonds that combine clear social benefits with sound financial attributes.

- Strength in partnership: Our strong reputation across both fixed income credit and social investment is enhanced by our social partnership with INCO Group1, an organisation focused on the European social economy and a leader in assessing sustainable social businesses.

- Proven track record in social bond investing: We have successfully managed outcomes-focused social bond strategies since 2013, and have over €1 billion invested in a range of strategies for clients in the UK, Europe and the US.

Risks to be aware of

This fund is suitable for investors who can tolerate a moderate level of risk in return for solid returns over a medium-term investment horizon. Investors should read the Prospectus for a full description of all risks.

Investment risks: Investment in debt securities, derivatives and currencies.

Associated risks: The fund may be exposed to additional credit, market, interest rate and liquidity risks due to the nature of investing in debt markets.

Investment approach

Outcome-focused approach aligned with SDGs

Social assessment methodology directs investments to positive social outcomes

Our social partner, INCO Group, brings its expertise and reputation by deepening the research on the social outcomes of potential investments; reviewing, advising and monitoring our social assessments via a quarterly Social Advisory Panel; and producing an independent annual report.

Insights

In search of sustainability – following Highway 101

The climate-health nexus: risks and opportunities

Green machines: the future of transport

Fund Manager

Simon Bond joined the company in 2003 and has been the portfolio manager of the Threadneedle UK Social Bond Fund since its launch in 2013, as well as the Threadneedle (Lux) European Social Bond Fund which launched in 2017. Having previously managed a number of institutional and retail investment grade corporate bond portfolios, Simon now concentrates his focus on managing Columbia Threadneedle's social bond portfolios and developing other responsible investment strategies across the firm.

Simon has 34 years' experience in the fund management industry, with the last 29 years specialising in corporate credit. Throughout his career, Simon has taken a keen interest in the social investment space and as an analyst the first entity Simon reported on was Peabody Trust and the first sector he covered was housing associations. Simon is particularly passionate about the role of infrastructure in both regeneration and economic growth.

Prior to joining the firm, Simon managed £6 billion in his role as the Senior UK Credit Fund Manager for AXA. Simon also worked for GE Insurance as a Portfolio Manager, Provident Mutual as a Fixed Income Analyst and Hambros Bank as an Investment Accountant and Pension Fund Investment Administrator.

Simon is a Fellow of the Chartered Institute for Securities and Investment, holds the Investment Management Certificate and the General Registered Representatives Certificate.

*The Fund is categorised an Article 8 under the EU Regulation 2019/2088 on sustainability related disclosures in the financial services sector (SFDR) and promote environmental or social characteristics as an objective.

Important Information

FOR PROFESSIONAL INVESTORS ONLY (not to be used with or passed on to any third party). Your capital is at risk.

This financial promotion is issued for marketing and information purposes only by Columbia Threadneedle Investments.

The Fund is a sub-fund of Columbia Threadneedle (Lux) I, a Luxembourg domiciled investment company with variable capital (“SICAV”), managed by Threadneedle Management Luxembourg S.A..

The SICAV´s current Prospectus, the Key Investor Information Document (KIID)/Key Information Document (KID) and the summary of investor rights are available in English and/ or in local languages (where applicable) from the Management Company Threadneedle Management Luxembourg S.A., International Financial Data Services (Luxembourg) S.A., your financial advisor and/or on our website www.columbiathreadneedle.com. Threadneedle Management Luxembourg S.A. may decide to terminate the arrangements made for the marketing of the SICAV. Pursuant to article 1:107 of the Act of Financial Supervision, the sub-fund is included in the register that is kept by the AFM. Past performance is calculated according to the BVI method in Germany.

These documents are available in Switzerland from the Swiss Representative and Paying Agent CACEIS Investor Services Bank S.A.. Esch-sur-Alzette, Zurich Branch, Bleicherweg 7, CH 8027 Zurich.

The Fund is categorised an Article 9 under the EU Regulation 2019/2088 on sustainability related disclosures in the financial services sector (SFDR) and promote environmental or social characteristics as an objective. The decision to invest in the promoted fund should take into account all the characteristics or objectives of the promoted fund as described in its prospectus. The fund’s sustainability related disclosures can be found on our website columbiathreadneedle.com.

The Fund is categorised an Article 8 under the EU Regulation 2019/2088 on sustainability related disclosures in the financial services sector (SFDR) and promote environmental or social characteristics as an objective. The decision to invest in the promoted fund should take into account all the characteristics or objectives of the promoted fund as described in its prospectus. The fund’s sustainability related disclosures can be found on our website columbiathreadneedle.com.

The Fund is categorised an Article 6 under the EU Regulation 2019/2088 on sustainability related disclosures in the financial services sector (SFDR) and DOES NOT promote environmental or social characteristics as an objective. Sustainability risks are integrated into the fund’s investment decisions making process for financial Risk Management purposes only.

This material should not be considered as an offer, solicitation, advice or an investment recommendation. An investment may not be suitable for all investors and independent professional advice, including tax advice, should be sought where appropriate. This communication is valid at the date of publication and may be subject to change without notice. Information from external sources is considered reliable but there is no guarantee as to its accuracy or completeness.

In Spain, Columbia Threadneedle (Lux) I is registered with the CNMV under No. 177. The Fund is a non-Spanish collective investment scheme duly registered with the CNMV for marketing in Spain. The fund should be subscribed to through locally authorised appointed distributors. Investors must read the relevant Prospectus and KID for each fund they want to invest before subscribing. All other statutory documentation, as well as the NAV can be obtained from www.columbiathreadneedle.com.

In the EEA and Switzerland: Issued by Threadneedle Management Luxembourg S.A. registered with the Registre de Commerce et des Sociétés (Luxembourg), Registered No. B 110242, 44 rue de la Vallée, L-2661 Luxembourg, Grand Duchy of Luxembourg. In the UK: Issued by Threadneedle Asset Management Limited. Registered in England and Wales, No. 573204. Registered Office: 78 Cannon Street, London EC4N 6AG, United Kingdom. Authorised and regulated in the UK by the Financial Conduct Authority. In the Middle East: This document is distributed by Columbia Threadneedle Investments (ME) Limited, which is regulated by the Dubai Financial Services Authority (DFSA). For Distributors: This document is intended to provide distributors with information about Group products and services and is not for further distribution. For Institutional Clients: The information in this document is not intended as financial advice and is only intended for persons with appropriate investment knowledge and who meet the regulatory criteria to be classified as a Professional Client or Market Counterparties and no other Person should act upon it.

This document may be made available to you by an affiliated company which is part of the Columbia Threadneedle Investments group of companies: Columbia Threadneedle Management Limited in the UK; Columbia Threadneedle Netherlands B.V. in the EEA; Columbia Threadneedle Investments (Swiss) GmbH in Switzerland, acting as representative office of Columbia Threadneedle Management Limited. Certain funds and/or share classes may not be available in all jurisdictions.

© Columbia Threadneedle Investments. Columbia Threadneedle Investments is the global brand name of the Columbia and Threadneedle group of companies.